Learn what Fintech is, what services it offers, its benefits, and how companies like PayPay, Rakuten, and Money Forward are leading this financial revolution.

The term Fintech comes from the combination of “financial” and “technology”, and refers to the use of technology to improve and streamline financial services.

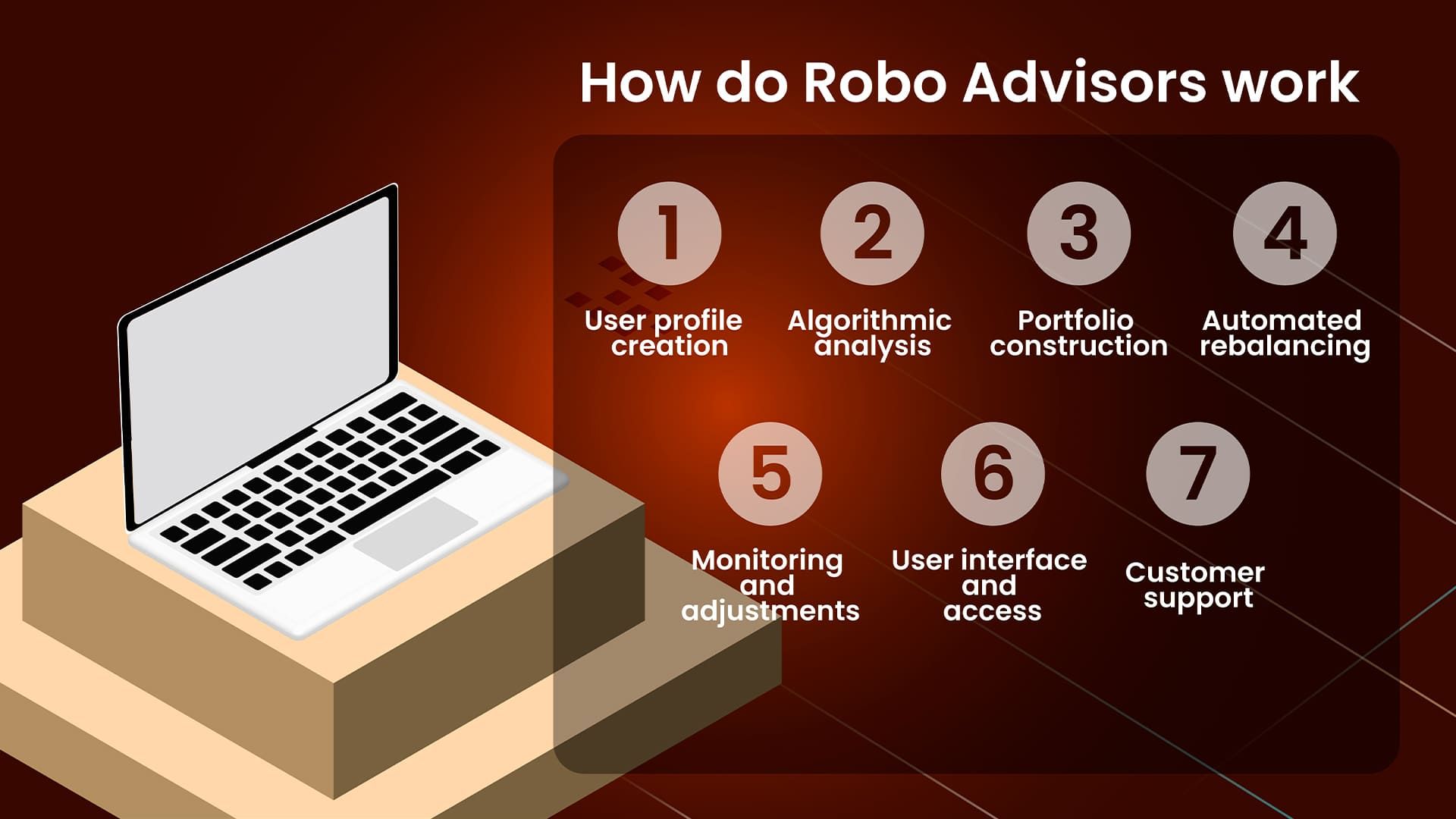

From mobile transfers to automated investment apps, Fintech aims to make managing money more accessible, faster, and more efficient.

Although the concept of Fintech has existed since the 1990s, it wasn’t until the 2010s that it gained global popularity. In countries like Japan, 2015 was considered the "zero year" of financial technology, driven by the mass adoption of smartphones and users’ direct access to financial services.

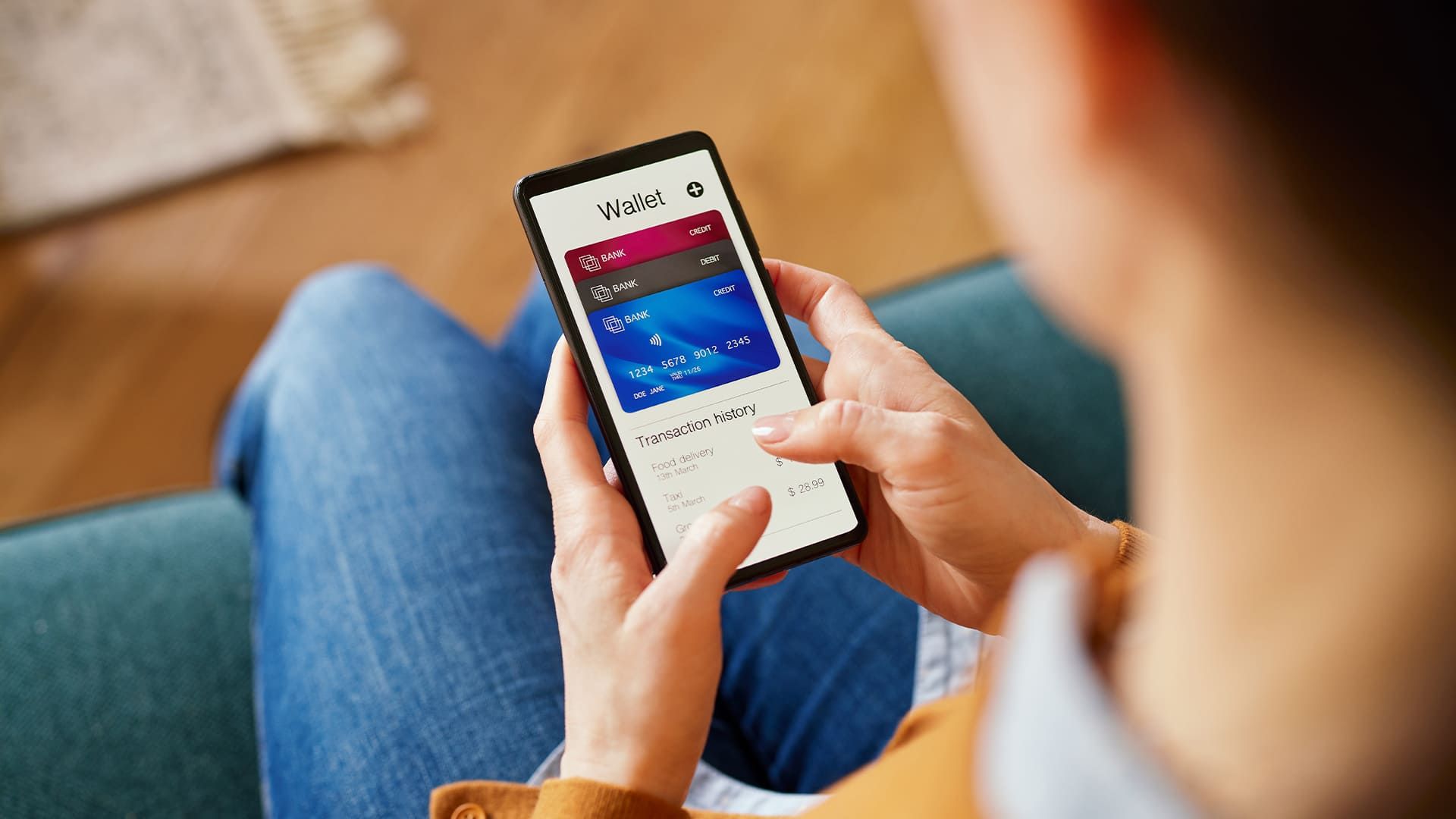

Today, Fintech is no longer the domain of banks and experts. Anyone can access financial services directly from their smartphone.

Fintech is a broad ecosystem, with solutions tailored to both individual users and businesses. Some examples include:

The evolution of Fintech has brought significant advantages to both users and businesses:

Several companies have been key in popularizing Fintech in everyday life:

Fintech is not a passing trend, but a natural evolution of the financial world. Thanks to it, we now have the power to manage our finances in the palm of our hand, more accessibly, quickly, and securely.

At Meetlabs, we believe that understanding these technologies is essential for businesses and users who want to adapt to the new digital landscape.